From the cutting of long-life tungsten carbide alloys to polished surgical steel, fluid-hydraulic pumps are used in the long array of manufacturing processes spanning a lot of different industries. Although, pumps are extravagant consumers of energy compared with other systems. However, recent breakthroughs in technology such as smart pump technology or “smart fluid hydraulics” are able to lead to further improvement in energy efficiency, productivity, and uptime.

These technologies do have some up-front expenditures, but companies are able to recover their investment through lower operating expenses. Want to know more about Creating value in the specialty pumps market?

The smart fluid hydraulics–equipment industry includes five main segments:

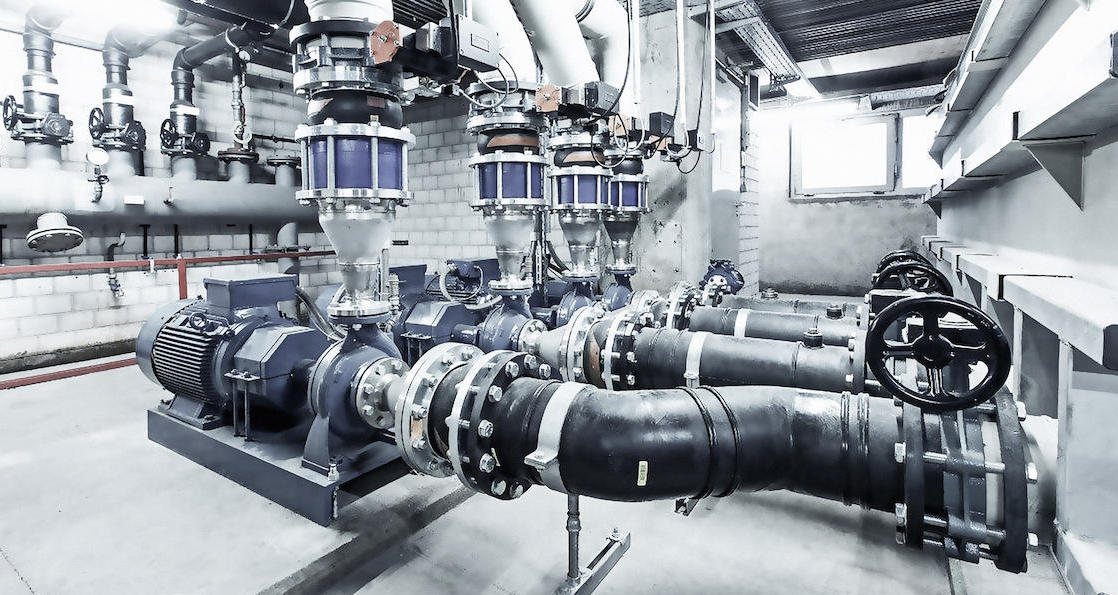

- Centrifugal pumps. Spinning impellers in these pumps, such as 70A180-22920536, add kinetic energy to a fluid. They are the largest segment, with a global market size of $ 30. Three billion dollars in 2019; within it, some €8. Six billion euros came from Europe alone that year. Seventy-nine percent was generated by single-stage and multi-stage pumps used for higher pressure applications, while submersible waters can be neglected as Positive-displacement pumps.

The pumps pressure-pump fluid by trapping a fixed amount of fluid in each stroke with the piston and then compressing it, displacing it. In the global pumps market in 2019, they represented $8.1 billion of revenue and most of it was generated by diaphragm, piston, and gear pumps.

Of that revenue, $ 1.6 billion was from the European Union alone. 3 Other pumps, including specialty pumps. They span a broad range of technical specifications. The technologies include jet engines, electromagnetic power, and gas compressors.

- Pump sets. The result is a single module that includes both the fluid hydraulics unit and the drivetrain. Special configurations, in which both are sold as an integrated system, began to appear on the market in 2010 and their share is expected to expand extremely.

- Pump services. This category includes plant maintenance, efforts to cut costs, and old asset infrastructure. In 2019 revenues for these services were US $ 15.6 billion worldwide. Core elements of strategy development. The application of smart hydraulics in process industries like steel, oil and gas, pulp and paper, pharmaceuticals, and food will be a big plus. In the European Union, industrial processes consume 42 percent of power and pumps consume the highest share (30 %).

Some OEMs have already introduced smart fluid-hydraulics products like 599-10330S and may have taken advantage of this competition in the market. However, companies developing new technologies can still capture enormous sales and growth potential.

Comments